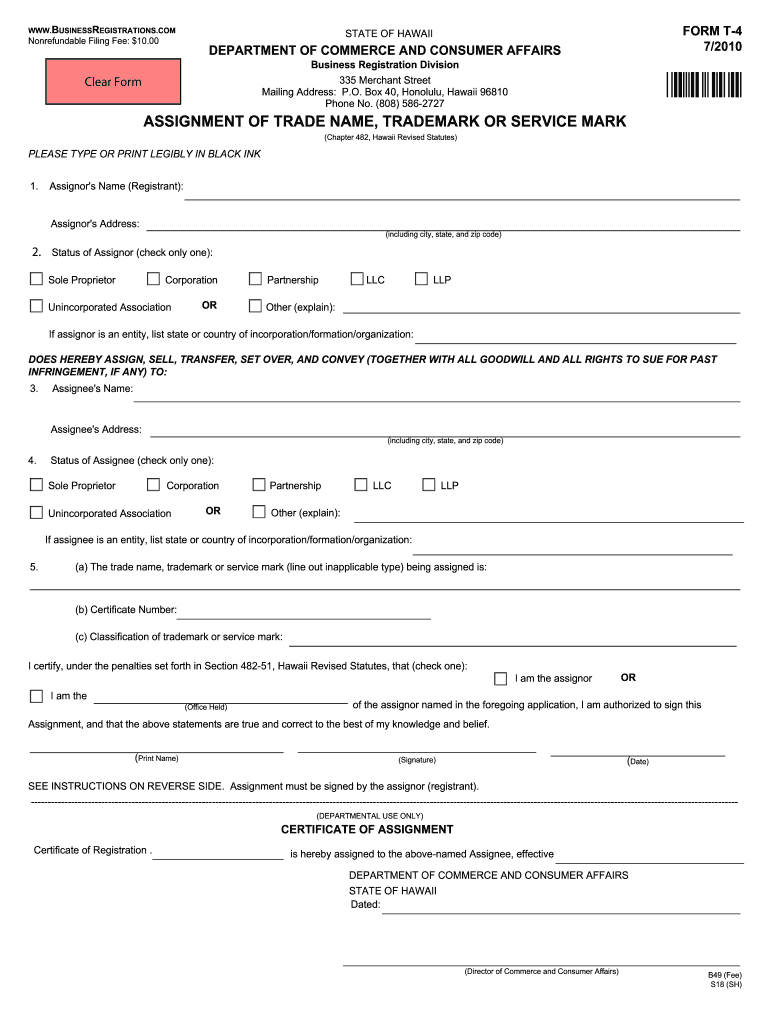

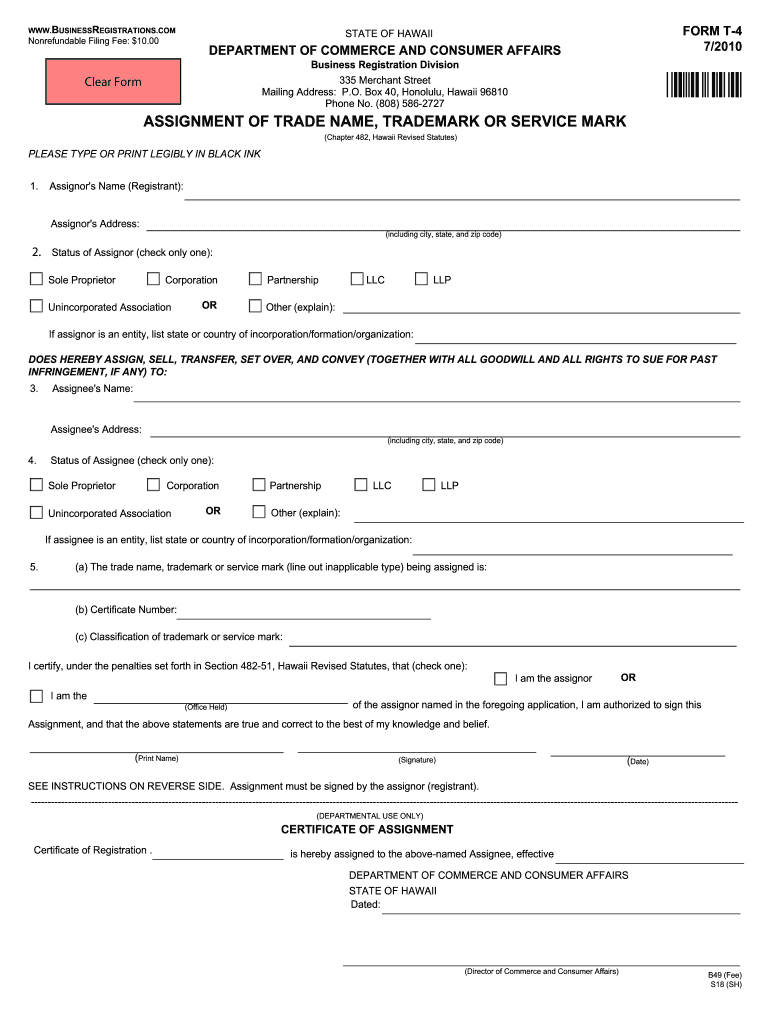

HI Form T-4 2010-2025 free printable template

Get, Create, Make and Sign hawaii t 4 form

Editing hawaii form assignment online

How to fill out hawaii form trademark

How to fill out HI Form T-4

Who needs HI Form T-4?

Video instructions and help with filling out and completing hawaii form t 4

Instructions and Help about hawaii t 4 name

There's my top ten strategies that real estate agents don't want you to know about how to get a great deal on a home or a condo in Hawaii and be sure to watch till the very end because I'm going to give you my best money saving tip at the end of this video hey guys Eric west here with Hawaii real estate or if you're new to this channel we're all about helping you learn everything you really need to know, but you won't find in the listing today I'm going to share with you the top 10 strategies that real estate agents don't want you to know about how to get a great deal on a home or condo in Hawaii strategy number one you have to know the market and what does that mean you won't know a deal unless you can recognize a deal, so it's very important that you get to know the market which actually feeds right into strategy number two and that is get on a regular update of the properties that you're looking to purchase that you can start to watch the market in other words say for example you're looking for a home and Kannapolis on Maui and you know you want to spend between one and two million dollars then my number two tip is to get on a search that will automatically send you new listings as they hit the market in that particular neighborhood, and then you'll start to learn the market also that search should include any souls that have occurred in that neighborhood in the last year and of course any upcoming sold and also any properties that go pending or under contract is very important information so tip number one and tip number two is get to know the market so that you can recognize the deal when it comes your way okay, so the first two strategies are pretty basic now we're going to dive into some more sort of unknown things that real estate agents really don't want you to know about number one is make sure that you are searching for a specific type of property called pending but cancelling which means what that means a property when under contract, but it's in the process of canceling but hasn't cancelled, yet I found many good real estate deals this way because why someone may have put that property under contract right away because it was such a great deal, but then it's gonna fall out because it couldn't get for their loan or a myriad of reasons, but there is actually a special category in the MLS where you can look at properties that are currently pending but are about to cancel at strategy number four this is definitely one that agents don't want you to know about and that is look for sale by owners and specifically look in Zillow for sale by owners or by my house now I suggest looking at all of them don't get me wrong, but the really cool ones are the ones that kind of don't make any sense maybe there are no pictures or maybe there's just not a lot of information which you might have there is somebody that wants to sell it themselves, but they don't have the computer skills to upload photos or fill out the ad correctly on Zillow that could...

People Also Ask about hawaii trade name trademark

Do you need a DBA in Hawaii?

How do I add a DBA to my LLC in Hawaii?

How do I add a DBA to an LLC in Hawaii?

How do I change my business address in Hawaii?

What is the difference between a trade name and a trademark?

How do I verify a business license in Hawaii?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file hawaii t 4?

How to fill out hawaii t 4?

What is the purpose of hawaii t 4?

What information must be reported on hawaii t 4?

How can I send hawaii t 4 trade to be eSigned by others?

How can I fill out t 4 trade name on an iOS device?

Can I edit hawaii form t4 mark fill on an Android device?

What is HI Form T-4?

Who is required to file HI Form T-4?

How to fill out HI Form T-4?

What is the purpose of HI Form T-4?

What information must be reported on HI Form T-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.